The Beginner's Guide to Understanding Carbon Credits. Part 3: The Benefits and Challenges of Carbon Offsetting

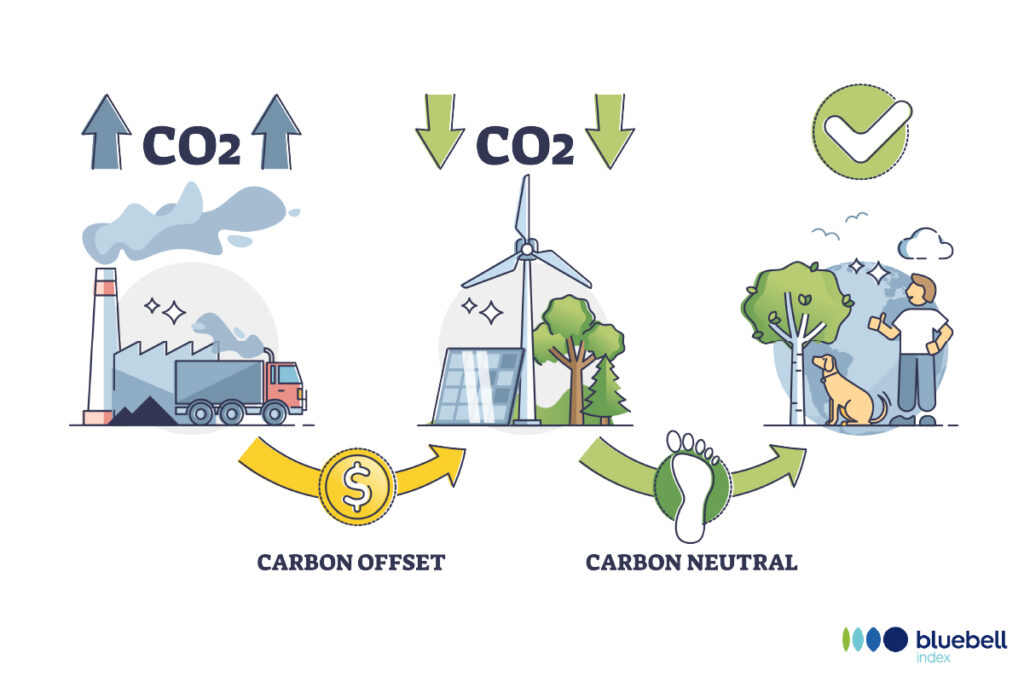

Carbon offsetting is a mechanism that allows individuals and organizations to compensate for their greenhouse gas (GHG) emissions by supporting projects that reduce or remove emissions elsewhere. While carbon offsetting can help to reduce the overall level of GHG emissions in the atmosphere, it is not without its challenges.

In this article, we’ll explore the benefits and challenges of carbon offsetting, including the importance of transparency and accountability in the carbon offsetting market. We’ll also discuss the different task forces that have been created to scale voluntary carbon markets.

Benefits of Carbon Offsetting

Carbon offsetting can have several benefits, including:

- Reducing GHG Emissions: By supporting projects that reduce or remove emissions elsewhere, carbon offsetting can help to reduce the overall level of GHG emissions in the atmosphere. This can help to slow down the rate of climate change and its impact on the environment.

- Supporting Sustainable Development: Many carbon offsetting projects are designed to support sustainable development in developing countries. For example, projects that provide access to clean energy can improve the health and well-being of local communities, while also reducing emissions.

- Improving Corporate Reputation: By supporting carbon offsetting projects, companies can demonstrate their commitment to sustainability and reduce their carbon footprint. This can help to improve their reputation and attract customers who are concerned about the environment.

Challenges of Carbon Offsetting

While carbon offsetting can have several benefits, it is not without its challenges. Some of the challenges of carbon offsetting include:

- Additionality: One of the key challenges of carbon offsetting is ensuring that the projects being supported are additional, meaning that they would not have happened without the support of carbon offsetting. This can be difficult to verify, and there have been cases of projects being double-counted or overstated.

- Leakage: Another challenge of carbon offsetting is leakage, which occurs when emissions are shifted from one place to another rather than being reduced overall. For example, if a project is designed to reduce emissions from deforestation, there is a risk that deforestation will simply move to another area.

- Lack of Transparency and Standards: The carbon offsetting market is largely unregulated, which can make it difficult for consumers to determine the legitimacy and impact of carbon offsetting projects. There is a need for greater transparency and standardization in the carbon offsetting market to ensure that consumers are making informed decisions.

Taskforces on Scaling Voluntary Carbon Markets

In recent years, there has been a growing recognition of the importance of scaling up voluntary carbon markets to help address climate change. In response, several task forces have been created to help scale up voluntary carbon markets, including:

- Taskforce on Scaling Voluntary Carbon Markets: The Taskforce on Scaling Voluntary Carbon Markets was created in 2020 by the International Emissions Trading Association (IETA) and the World Economic Forum (WEF). The task force is focused on identifying and addressing the barriers to scaling up voluntary carbon markets.

- Taskforce on Scaling Voluntary Offsetting: The Taskforce on Scaling Voluntary Offsetting was created in 2021 by the Science Based Targets initiative (SBTi), the Gold Standard, and the VERIFIED CARBON STANDARD ASSOCIATION (VCS). The task force is focused on developing guidance for companies on how to scale up voluntary offsetting while ensuring that the offsetting is high-quality and credible.

- Taskforce on Climate-Related Financial Disclosures (TCFD): The FSB Task Force on Climate-related Financial Disclosures (TCFD) was created by the Financial Stability Board (FSB) in 2015 to develop recommendations for voluntary climate-related financial disclosures. The TCFD has encouraged companies to disclose their carbon footprint and climate-related risks and opportunities.

- Taskforce on Nature-related Financial Disclosures (TNFD): The Taskforce on Nature-Related Financial Disclosures is an international initiative that builds on a model developed by the Taskforce on Climate-Related Financial Disclosures (TCFD). Its mission is to provide a framework for how organizations can address environmental risks and opportunities with the ultimate goal of channeling capital flows into positive action.

These task forces are private-sector-led initiative aimed at developing a blueprint for scaling the voluntary carbon market, setting standards for carbon credits, and increasing transparency and accountability in the market.

Also, they are focused on developing guidance for companies on how to scale up voluntary offsetting while ensuring that the offsetting is high-quality and credible.

Another goal is to create greater integrity and transparency in the voluntary carbon markets by developing standards and guidelines for carbon offset projects, as well as exploring ways to ensure that carbon credits are not double-counted or misused.